Redwood Marketplace

Online Marketplace for Global Liquefied Natural Gas

Challenge

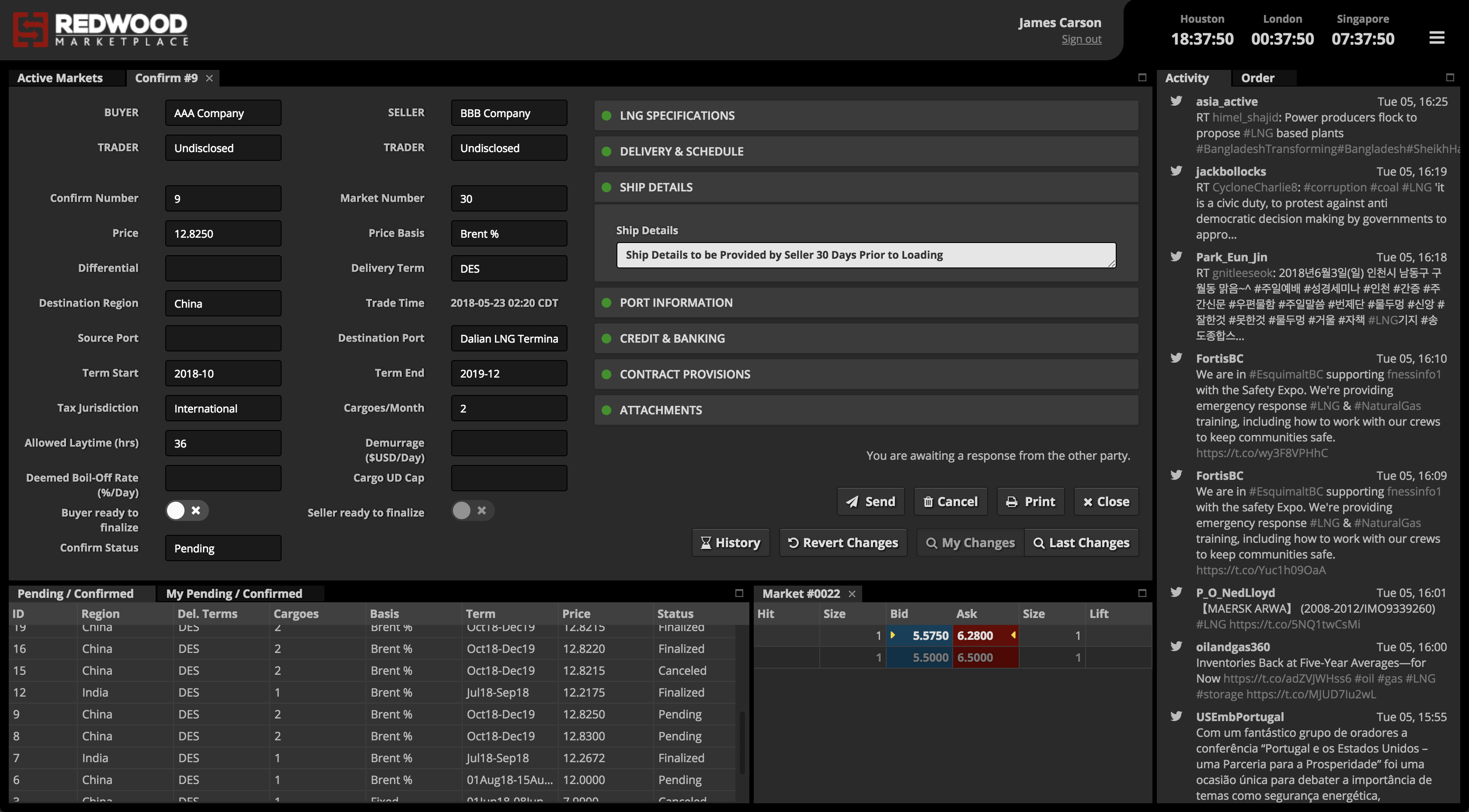

Evolving markets strive to find liquidity through the gradual reduction of impediments to trade that create friction in the transaction process. This can include impediments throughout the transaction life cycle, such as lack of price visibility, disorganized market design, fragmented venues for trade, complex and non-standard commercial terms, expensive or cumbersome credit and security instruments, and many others.

A central marketplace designed specifically to address the trading impediments in a commodity market is critical to the development of liquidity, however it is equally important that the marketplace is designed specifically for the unique challenges of the commodity market it serves.

Result

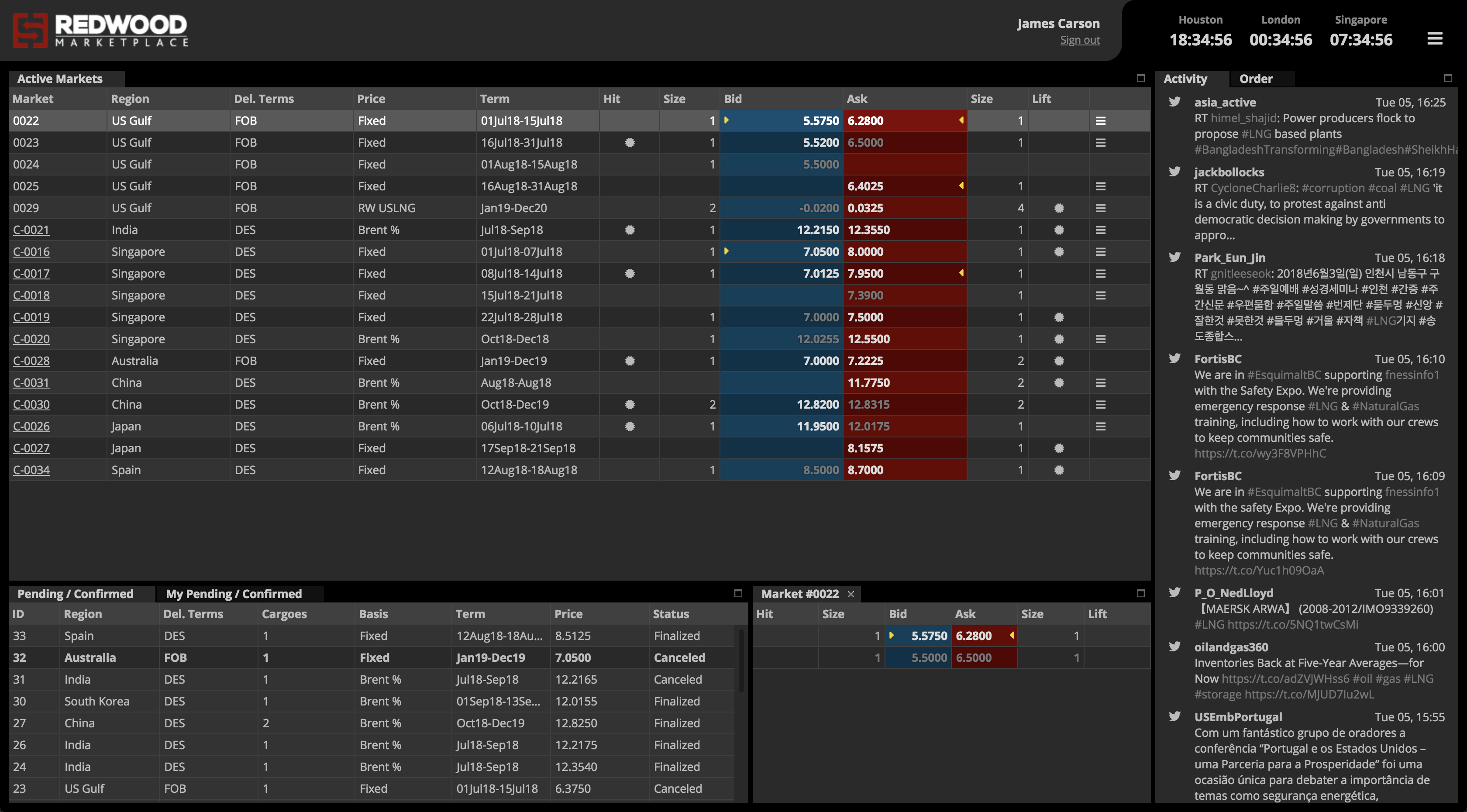

The Redwood Marketplace identifies and presents a set of solutions to bring liquidity to the unique challenges of the global market for physical liquefied natural gas (LNG).

The Redwood Marketplace provides visibility into all elements of the transaction life cycle, from bids and offers on standard regional markets to pending/confirmed transactions and differential or basis pricing to standard markets. To make prudent decisions in a rapidly evolving market, it is important to have timely market data from a reliable, neutral and independent central marketplace.